Bitcoin Skyrockets to Record High

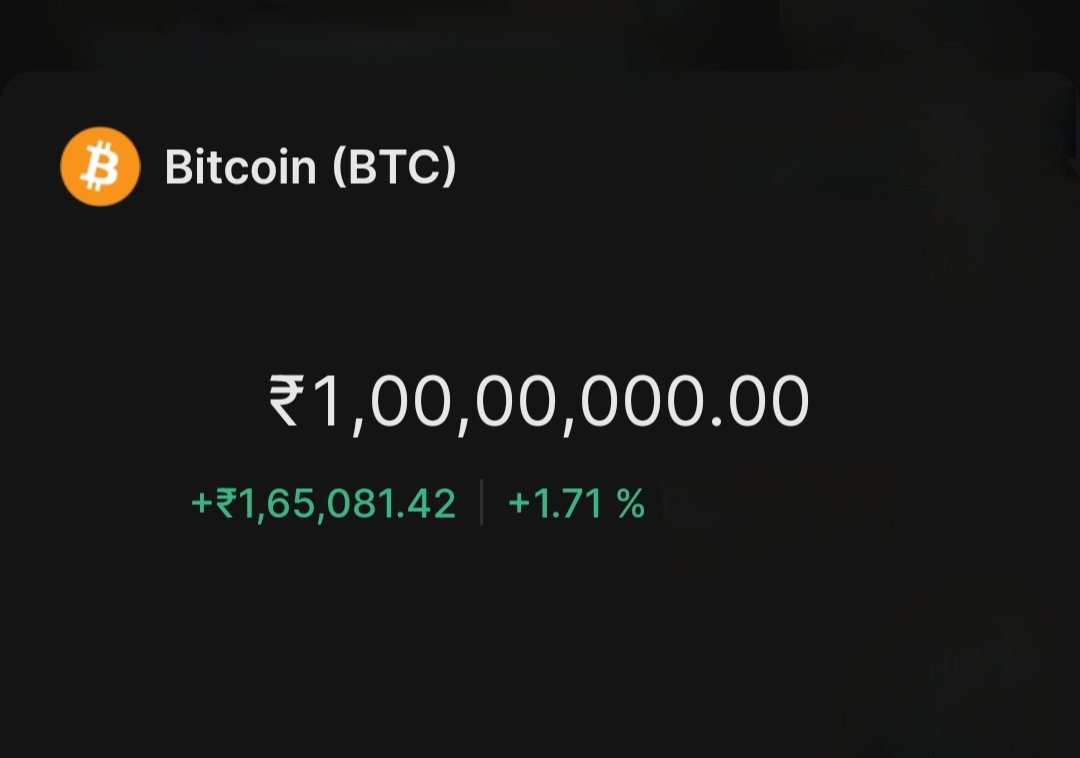

Bitcoin surged past $118,000, marking a new all-time high. This surge driven by strong institutional demand and momentum into Crypto Week signals the cryptocurrency’s growing acceptance as a mainstream asset.

Drivers Behind the Breakout

- Massive ETF Inflows

- A single day saw nearly $1.18 billion injected into Bitcoin spot ETFs, pushing total 2025 inflows to around $51 billion. These funds are making it easier than ever for institutions and retail investors to gain Bitcoin exposure.

- Short Squeeze Explosion

- Over $1 billion in short positions were liquidated within 24 hours forcing sellers into the market and rapidly inflating Bitcoin prices. One trader alone lost $88 million on HTX during the frenzy.

- Pro-Crypto Regulation

- The U.S. government adopted a friendly stance toward digital assets, backing bills like the GENIUS Act, proposing a national Bitcoin reserve, and encouraging institutional participation. Combined with upcoming “Crypto Week,” sentiment turned strongly bullish.

- Macroeconomic Appeal

- With concerns over inflation, a weakening U.S. dollar, and global trade instability, Bitcoin is increasingly viewed as a “digital gold” a hedge and safe haven amid uncertainty.

Technical Snapshot & Next Price Targets

- Breakout Observed: Bitcoin recently broke resistance around $110K–$112K, producing long green candles and elevated trading volume a classic bullish signal.

- Next Target: Analysts expect Bitcoin to test $120K+. Looking further, mid-term projections suggest $145K–$160K, and a few bullish forecasts even stretch to $200K+ in the coming months.

- Support Levels: If Bitcoin pulls back, expect it to stabilize around $113K–$115K, setting up for a possible replay of the rally.

Takeaways for Traders & Investors

Bitcoin is skyrocketing, thanks to a surge in institutional demand over $1 billion flowed into Bitcoin ETFs in a single day, pushing total 2025 inflows to around $51 billion . This wave of money is giving Bitcoin a significant boost, signaling that large-scale investors are piling in.

At the same time, a major short squeeze sent prices even higher: over $1 billion worth of short positions were liquidated in just one day, as Bitcoin breached resistance above $112,000, forcing bearish bets to get covered.

On the charts, Bitcoin has confidently broken past its previous ceiling between $110K–$112K, with strong buying momentum and volume. Analysts now set their sights on $120K as the next milestone, with some anticipating further upside toward $140K–$160K later this year .

Favorable policy moves have also played a role. Pro-crypto developmentssuch as strategic reserve discussions and new legislation alongside dovish signals from regulators, are giving the market confidence and potentially paving the way for the next rally.

Why Trump’s Tariffs Matter Today

- 35% Tariff on Canada & Broader Threats

- President Trump has announced a steep 35% tariff on Canadian imports (up from 25%), set to begin August 1. He’s also preparing blanket 15–20% duties on trade with nations like the EU, Japan, South Korea, and Brazil, further escalating his “Liberation Day” tariff policy. The stated goals: address U.S.-Canada trade imbalances, curb fentanyl flows, and protect American industries.

- Copper & Brazilian Goods Face 50% Tariffs

- In parallel, a 50% tariff on copper imports and Brazilian goods was announced. The ambition: boost domestic U.S. mining and manufacturing capacity. However, U.S. refined copper production currently covers just half of the nation’s needs, suggesting costs for manufacturers and consumers will rise unless domestic production rapidly scales.

- Market Reaction: Mixed Calm

- Surprisingly, global markets have remained relatively steady:

- Currencies: The U.S. dollar strengthened while the Canadian dollar, euro, and yen slipped.

- Stocks & Bonds: U.S. futures and Asian markets saw muted fluctuations; while gold climbed as investors sought safe-haven assets.

- Commodities: Copper prices jumped to record highs, reflecting tariff concerns.

- Global Trade Uncertainty Rises

- The International Monetary Fund raised concerns, warning that higher tariffs are increasing global economic uncertainty. Additionally, the International Chamber of Commerce estimated U.S. consumers could face an effective tariff rate exceeding 20%, echoing levels not seen since the 1930s. Despite this, financial markets appear to be pricing it in cautiously.

- Political & Economic Implications

- Canada & EU are preparing responses, including possible counter-tariffs and trade boycotts.

- The U.S. Treasury has reported approximately $100 billion collected from tariffs so far, with projections to reach $300 billion by year-end.

- Legislation like the Trade Review Act aims to give Congress more oversight, signaling rising political pushback at home.