Indian Stock Market News Today – 03 July 2025

The Indian stock market closed in green on July 4, 2025, with the Sensex rising 193 points to 83,432.89 and the Nifty gaining 55 points to end at 25,461. Banking stocks led the rally, with ICICI Bank and Axis Bank outperforming, while Kotak Mahindra Bank saw marginal gains. Market sentiment remained cautious after SEBI barred US quant firm Jane Street over alleged derivative manipulation. Maruti Suzuki and Tata Steel were among the top losers. Investors also awaited clarity on US tariffs set for July 9. Despite global uncertainties, analysts remain optimistic about Nifty’s potential to hit record highs, backed by strong domestic momentum and Q1 earnings optimism.

Indian Stock Market News Today – Index Closing

- BSE Sensex: 83,432.89 (+193.4 pts / +0.23%)

- NSE Nifty 50: 25,461.00 (+55.7 pts / +0.22%)

- Bank Nifty: 57,812.40 (+113.2 pts / +0.20%)

- Rupee: ₹84.92 / $ (strengthened, gaining 0.3%)

- Crude Oil: $70.25 per barrel (Brent)

- Gold: ₹97,210 per 10 grams (24K)

Indian Stock Market News Today – Market Summary (04 July 2025)

The Indian stock market ended in the green on 04 July 2025, extending its upward momentum despite global concerns. The Sensex closed at 83,432.89, up by 193.4 points (0.23%), while the Nifty 50 gained 55.7 points (0.22%) to settle at 25,461.00. Bank Nifty also advanced by 0.20%, finishing at 57,812.40.

Banking and financial stocks led the rally, with ICICI Bank and Axis Bank posting strong gains. Kotak Mahindra Bank ended marginally higher. However, auto and metal stocks remained under pressure, as Maruti Suzuki and Tata Steel declined sharply.

Investor sentiment was affected by SEBI’s action against Jane Street, a U.S.-based quant firm, for alleged derivatives manipulation. Global uncertainty surrounding the upcoming U.S. tariff decision on July 9 also kept markets cautious.

On the currency front, the Rupee appreciated slightly to ₹84.92 against the USD. In commodities, crude oil held near $70.25 per barrel, and gold remained strong at ₹97,210 per 10 grams.

Despite external pressures, analysts believe domestic strength and upcoming Q1 earnings could help Nifty 50 approach record highs in the coming weeks.

Indian Stock Market News Today – Top 5 Gainers

| Stocks | Gain (%) |

|---|---|

| Bajaj Finance | +1.66% |

| Infosys | +1.36% |

| Dr. Reddy’s Laboratories | +1.00% |

| ICICI Bank | +1.09% |

| Hindustan Unilever (HUL) | +1.12% |

- Bajaj Finance

- Bajaj Finance surged as investors responded positively to early Q1 loan book growth estimates. Strong consumer lending demand and festive pre-bookings boosted sentiment around NBFCs.

- Infosys

- Infosys gained on renewed optimism around IT spending recovery in the US. Analysts also pointed to improved margin guidance and potential large deals in the pipeline.

- Dr. Reddy’s Laboratories

- Dr. Reddy’s rose after reports of strong USFDA inspection clearance at key facilities. Expectations of robust export earnings also supported bullish sentiment.

- ICICI Bank

- ICICI Bank climbed following steady retail credit growth and improving asset quality. Its consistent digital innovation also attracted institutional buying.

- Hindustan Unilever (HUL)

- HUL moved higher on signs of rural demand recovery and easing input cost pressures. Brokerages upgraded the stock ahead of its Q1 results.

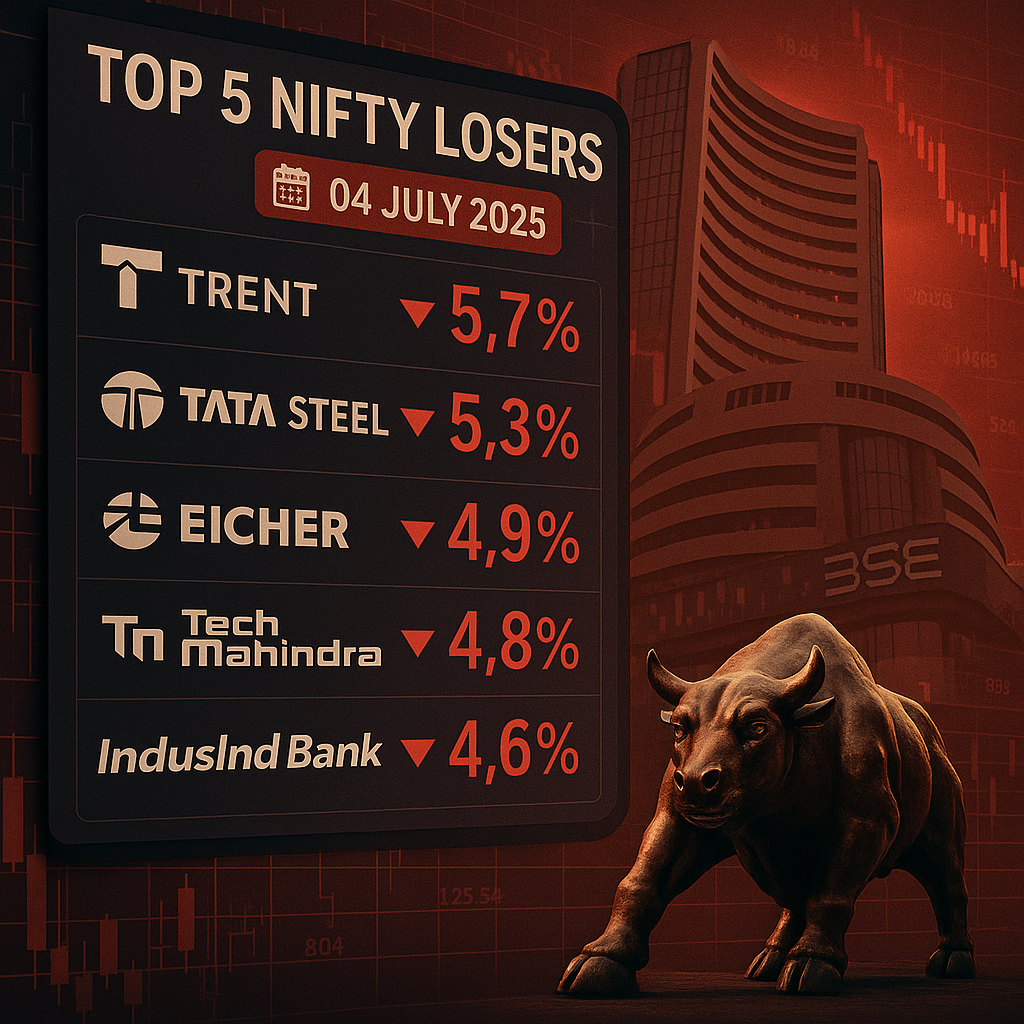

Indian Stock Market News Today – Top 5 Nifty Losers

| Stocks | % Loss |

|---|---|

| Trent | -11.4% |

| Tata Steel | -1.7% |

| Eicher Motors | -1.6% |

| IndusInd Bank | -0.9% |

| Maruti | -0.82 |

- Trent

- Shares plunged after the company reported 20% YoY sales growth, well below its historic 35% growth rate, and the near-term forecast fell short of investor expectations.

- Tata Steel

- The metal major underperformed amid muted global steel demand and profit-taking, closing well below its 52-week high.

- Eicher Motors

- The luxury bike maker was dragged down by broader auto sector weakness, likely due to weaker demand outlook.

- Tech Mahindra

- The IT heavyweight slipped on lower trading volumes and muted demand optimism in the tech sector.

- IndusInd Bank

- The private lender saw a drop, likely as financial stocks took a hit from SEBI’s action against Jane Street, which impacted market-making volumes.

Final Takeaway

The Indian stock market news today highlights a cautious yet positive close on 04 July 2025, with the Nifty 50 and Sensex ending in the green. While banking giants like ICICI Bank and Kotak Mahindra Bank supported the rally, heavyweights like Trent and Tata Steel dragged overall sentiment. Global uncertainty—especially the SEBI ban on Jane Street and the upcoming U.S. tariff decision—kept traders alert. Still, strong domestic fundamentals and optimism around Q1 earnings suggest that Indian indices may trend upward. Investors are advised to watch key developments closely in the coming week for further cues.