R. Thyagarajan Early Life and Origins

R. Thyagarajan was born into a Tamil family in Chennai, emerging from humble beginnings that would later shape his understanding of common people’s financial needs. Coming from a prosperous farming family background in Tamil Nadu, he witnessed firsthand the challenges faced by ordinary citizens in accessing formal financial services, an experience that would profoundly influence his entrepreneurial vision.

His early years in Chennai exposed him to the diverse socio-economic landscape of South India. This foundational experience instilled in him a deep understanding of grassroots financial requirements and the gap between formal banking systems and common people’s needs. These formative years laid the groundwork for his future mission of financial inclusion and democratization.

R. Thyagarajan Educational Foundation

He holds a master’s degree in Mathematics and master’s degree in Mathematical Statistics from the Indian Statistical Institute. This rigorous academic background provided him with analytical skills and quantitative expertise that would prove invaluable in the financial services sector. His mathematical foundation enabled him to understand complex financial models and risk assessment techniques.

Key Educational Achievements:

- Master’s in Mathematics

- Master’s in Mathematical Statistics from Indian Statistical Institute, Kolkata

- Three-year specialized program at ISI, one of India’s premier institutions

- Strong foundation in statistical analysis and mathematical modeling

His education at the prestigious Indian Statistical Institute in Kolkata for three years provided him with advanced analytical capabilities. This academic excellence would later translate into innovative financial products and risk management strategies that became hallmarks of the Shriram Group’s success in serving underserved market segments.

R. Thyagarajan Early Career Journey

In 1961, he started his career as a Trainee Officer with New India Assurance Co. Limited, a general insurance company. This marked the beginning of his two-decade journey in the insurance and financial services industry. His early career provided crucial insights into insurance operations, customer service, and market dynamics that would shape his entrepreneurial approach.

During his twenty-year tenure as an employee in various finance companies, Thyagarajan gained comprehensive experience across different aspects of financial services. This extensive exposure to operational challenges, customer needs, and market gaps provided him with the practical knowledge necessary to later revolutionize financial service delivery in India.

His employee experience taught him the importance of customer-centric approaches and efficient service delivery. These lessons would later become fundamental principles in building the Shriram Group’s reputation for accessible and responsive financial services, particularly for underserved segments of the Indian population.

R. Thyagarajan The Entrepreneurial Leap

Shriram Group was founded on 5 April 1974 by R. Thyagarajan, AVS Raja and T. Jayaraman. At the age of 37, after two decades of corporate experience, Thyagarajan took the bold step of co-founding Shriram Chits with relatives and friends. This entrepreneurial decision marked the beginning of what would become one of India’s largest financial conglomerates.

Founding Partners:

- R. Thyagarajan (Founder Chairman)

- AVS Raja (Co-founder)

- T. Jayaraman (Co-founder)

The decision to start with chit funds was strategic, as it addressed a genuine need in the market for organized savings and credit mechanisms. The group had its beginning in chit funds business and later on entered the lending and insurance businesses. This foundation provided the capital base and customer understanding necessary for future expansion.

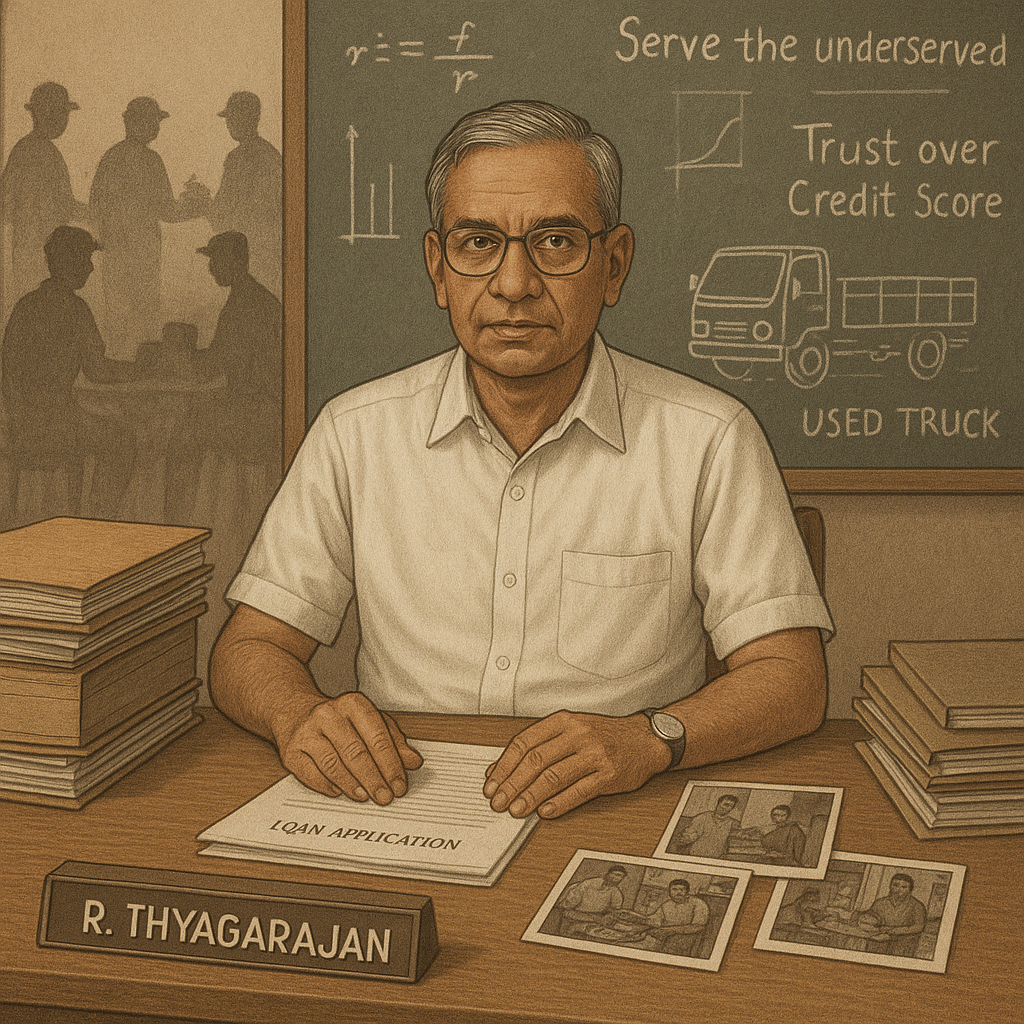

R. Thyagarajan Business Philosophy and Vision

Thyagarajan’s business philosophy centered on financial inclusion and serving the underserved segments of Indian society. The Shriram Group initially began as a small enterprise focused on providing financial services to underserved segments of the Indian population. His vision was to democratize access to financial services and create wealth for common people through organized savings and lending mechanisms.

His approach differed from traditional banking by focusing on relationship-based lending and understanding local market dynamics. This customer-centric philosophy emphasized trust, accessibility, and personalized service delivery. The emphasis on serving rural and semi-urban markets became a key differentiator in the competitive financial services landscape.

Core Business Principles:

- Financial inclusion for underserved segments

- Relationship-based lending approach

- Local market understanding

- Trust and accessibility focus

- Personalized service delivery

R. Thyagarajan Strategic Decision Making

Thyagarajan’s strategic acumen was evident in his methodical expansion approach. Rather than aggressive diversification, he focused on deepening expertise in core areas before expanding into adjacent services. This measured approach ensured sustainable growth while maintaining service quality and customer trust throughout the organization’s evolution.

His decision-making process emphasized thorough market research and customer feedback integration. By maintaining close connections with grassroots operations, he ensured that strategic decisions remained aligned with customer needs and market realities. This approach helped the group avoid many pitfalls that affected other financial service providers.

Strategic Strengths:

- Methodical expansion approach

- Customer-centric decision making

- Market research integration

- Grassroots connection maintenance

- Risk-balanced growth strategy

R. Thyagarajan Business Empire Expansion

Over the years, however, it expanded into various sectors, including insurance, retail finance, and asset management. The group’s systematic diversification from chit funds to comprehensive financial services demonstrated Thyagarajan’s strategic vision and execution capabilities. Each expansion was carefully planned to leverage existing customer relationships and operational expertise.

Shriram Finance is the flagship company of the Group which provides financial services such as commercial vehicle finance, passenger vehicle finance, SME finance and retail lending (personal loans, gold loans and two-wheeler loans). This diversified portfolio created multiple revenue streams while serving varied customer segments across the economic spectrum.

Business Portfolio:

- Chit Funds (Original business)

- Life Insurance

- General Insurance

- Vehicle Finance

- SME Finance

- Retail Lending

- Asset Management

R. Thyagarajan Organizational Growth

Today, the group has over 45,000 employees operating through 2,400 branches and manages funds of over Rs. 60,000 crores. This massive scale reflects the organization’s systematic growth under Thyagarajan’s leadership. The extensive branch network ensures widespread accessibility while maintaining local market connections that remain crucial to the group’s success.

The group’s employment generation impact extends beyond direct jobs to supporting ecosystem partners, agents, and service providers. This multiplier effect demonstrates the broader economic contribution of Thyagarajan’s vision beyond just financial services delivery. The organization’s scale enables it to serve millions of customers across India.

Organizational Scale:

- 45,000+ employees

- 2,400+ branches nationwide

- Rs. 60,000+ crore funds under management

- Millions of customers served

- Comprehensive service network

R. Thyagarajan Leadership Philosophy

Thyagarajan’s leadership style emphasized empowerment, trust, and shared growth. His approach focused on building strong organizational culture while maintaining entrepreneurial agility. The emphasis on employee development and customer service excellence became defining characteristics of the Shriram Group’s operational philosophy throughout its expansion phases.

His leadership philosophy balanced growth ambitions with social responsibility. By maintaining modest personal lifestyle while building a business empire, he demonstrated that successful entrepreneurship can coexist with ethical values and social commitment. This approach earned him respect beyond business circles.

Leadership Characteristics:

- Employee empowerment focus

- Trust-based management

- Entrepreneurial agility

- Social responsibility

- Modest personal lifestyle

- Ethical business practices

R. Thyagarajan Challenges and Resilience

Like any large organization, the Shriram Group faced various challenges including regulatory changes, market volatility, and competitive pressures. Thyagarajan’s ability to navigate these challenges while maintaining growth trajectory demonstrated his resilience and adaptability. His experience-based approach helped the organization weather multiple economic cycles successfully.

The group’s focus on serving underserved segments sometimes meant dealing with higher operational costs and credit risks. However, Thyagarajan’s systematic approach to risk management and customer relationship building helped mitigate these challenges while maintaining profitable operations across diverse market conditions.

Key Challenges Overcome:

- Regulatory compliance requirements

- Market volatility management

- Competitive pressure navigation

- Higher operational costs

- Credit risk management

- Economic cycle fluctuations

R. Thyagarajan Recognition and Honors

He was awarded the Padma Bhushan, India’s third highest civilian award, in 2013 in the field of trade and industry. This prestigious recognition acknowledged his contributions to Indian financial services and his role in promoting financial inclusion. The honor reflected not just business success but also social impact through democratizing access to financial services.

In 2013, he was awarded the Padma Bhushan, India’s third-highest civilian honour, for his contributions to trade and industry. This national recognition validated his vision of serving underserved segments and building a sustainable business model that creates value for all stakeholders including customers, employees, and society.

Awards and Recognition:

- Padma Bhushan (2013)

- Industry leadership recognition

- Social impact acknowledgment

- Financial inclusion pioneer

- Trade and industry contributions

R. Thyagarajan Philanthropic Legacy

Notably, he made headlines by donating almost his entire wealth of Rs 6210 crore (USD 750 million) to his employees, reflecting his commitment to the well-being of those who contributed to his empire’s success. This unprecedented act of generosity demonstrated his belief in shared prosperity and employee welfare above personal wealth accumulation.

Thyagarajan’s personal choices mirror his philanthropic endeavours. His decision to live modestly while building a business empire and ultimately donating his wealth to employees reflects a unique approach to wealth creation and distribution. This philosophy emphasizes stakeholder capitalism over pure profit maximization.

Philanthropic Impact:

- Rs. 6,210 crore wealth donation

- Employee welfare prioritization

- Shared prosperity philosophy

- Stakeholder capitalism approach

- Social responsibility demonstration

R. Thyagarajan Personal Values and Lifestyle

Despite building a financial empire, Thyagarajan maintained a remarkably modest lifestyle. Reports indicate he doesn’t own a mobile phone and drives a modest car worth around Rs. 6 lakh. This simplicity reflects his core values and demonstrates that business success doesn’t require extravagant personal consumption or lifestyle inflation.

His personal choices serve as an inspiration for entrepreneurs and business leaders, showing that authentic success comes from value creation rather than personal wealth accumulation. This approach has earned him respect not just as a successful businessman but as a role model for ethical leadership and social responsibility.

Personal Characteristics:

- Modest lifestyle maintenance

- Simple living philosophy

- Value creation focus

- Ethical leadership example

- Social responsibility demonstration

- Authentic success definition

R. Thyagarajan Legacy and Impact

Today, the Shriram Group stands as a financial powerhouse, serving as a lifeline for millions and securing its place as a leader in the sector. Thyagarajan’s vision of financial inclusion has transformed millions of lives by providing access to organized financial services. His legacy extends beyond business success to social impact and industry transformation.

The Shriram Group’s model of serving underserved segments while maintaining profitability has influenced the entire financial services industry. Many institutions have adopted similar approaches to financial inclusion, validating Thyagarajan’s early vision and demonstrating its scalability across different market contexts and business models.

Legacy Achievements:

- Financial inclusion pioneer

- Industry transformation leader

- Social impact creator

- Millions of lives touched

- Sustainable business model

- Employee welfare champion

R. Thyagarajan Future Vision

Under Thyagarajan’s foundational leadership, the Shriram Group continues to evolve with changing market dynamics while maintaining its core values of financial inclusion and customer service excellence. The organization’s digital transformation initiatives and product innovations reflect the enduring relevance of his vision in contemporary financial services landscape.

The group’s continued growth and expansion into new markets demonstrate the sustainability of Thyagarajan’s business model and philosophy. His emphasis on employee development, customer service, and social responsibility provides a strong foundation for future generations of leaders to build upon while adapting to evolving market requirements.

Future Outlook:

- Digital transformation initiatives

- Market expansion opportunities

- Product innovation focus

- Leadership development programs

- Social responsibility continuation

- Sustainable growth trajectory

Conclusion

R. Thyagarajan’s journey from a mathematics graduate to building one of India’s largest financial conglomerates represents the power of vision, persistence, and ethical leadership. His story demonstrates that successful entrepreneurship can create value for all stakeholders while maintaining social responsibility and personal integrity throughout the growth journey.

His legacy of financial inclusion, employee welfare, and modest living serves as an inspiration for current and future entrepreneurs. The Shriram Group’s success under his leadership proves that businesses can achieve scale and profitability while serving social needs and maintaining ethical standards in competitive market environments.

- Financial inclusion for underserved communities

- Relationship-based lending

- Trust and accessibility

- Employee ownership and empowerment

- Simplicity and ethical leadership

- Shriram Finance

- Shriram Life Insurance

- Shriram General Insurance

- Shriram Chits

- Shriram Housing Finance